Posted on 7th Jun 2020 by the LSS team

#investment process

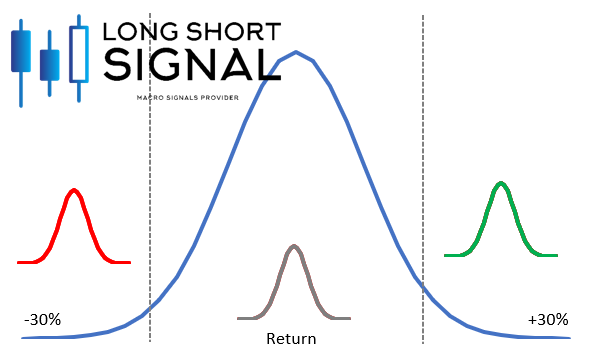

Traditional portfolio management on the buy-side often still centres around Modern Portfolio Theory, a half a century old (!) model which describes the idea that the expected return of a portfolio can be maximized for a given level of market risk and one combination of portfolio exposures provides the "optimal" portfolio. This theory treats historical returns as a continuum: 2008 (-38% return on stocks) and 2019 (+30% return on stocks) are opposite parts of the same return distribution. Instead, our investment process utilizes quantitative regime shifting models which have the underlying understanding that markets behave differently during good and bad times, and with a degree of statistical certainty, we can estimate what regime we are in today, aiding your investment decisions.... Read More

Traditional portfolio management on the buy-side often still centres around Modern Portfolio Theory, a half a century old (!) model which describes the idea that the expected return of a portfolio can be maximized for a given level of market risk and one combination of portfolio exposures provides the "optimal" portfolio. This theory treats historical returns as a continuum: 2008 (-38% return on stocks) and 2019 (+30% return on stocks) are opposite parts of the same return distribution. Instead, our investment process utilizes quantitative regime shifting models which have the underlying understanding that markets behave differently during good and bad times, and with a degree of statistical certainty, we can estimate what regime we are in today, aiding your investment decisions.... Read More

Posted on 27th Jun 2020 by the LSS team

#investment process #diversification #market views

So far, 2020 has been nothing if not a wild ride for financial markets. The S&P500 started the year on a slow upwards grind and was up as much as 5% by February (which would have been a respectable result for the entire year if it had only stayed there). It then started dumping to the bottom from 19th February onwards, eventually going as far down as -30%. We all know what happened next as central banks stepped in to save the day, one after the other. Today, it would appear to me that markets remain fragile as risk levels remain elevated and concerns about things like global economic growth and the impact of COVID-19 but also geopolitics, trade friction, upcoming US elections etc. continue to weigh on sentiment.... Read More

Posted on 28th Jun 2020 by the LSS team

#signals #investment process #model portfolio

I wanted to share a quick few thoughts with you about using our signals in your investment process, and what to expect in terms of win rates. Are we at LongShortSignal actually able to predict the market, if so why is no one else doing it and exactly how game-changing is our output? Those are a few of the things I will go into in this very short piece. For starters, it is my firm belief that markets are inherently unpredictable to an extent and there's no magic potion that will allow anyone to predict how assets will behave today, tomorrow or a week from now. ... Read More

I wanted to share a quick few thoughts with you about using our signals in your investment process, and what to expect in terms of win rates. Are we at LongShortSignal actually able to predict the market, if so why is no one else doing it and exactly how game-changing is our output? Those are a few of the things I will go into in this very short piece. For starters, it is my firm belief that markets are inherently unpredictable to an extent and there's no magic potion that will allow anyone to predict how assets will behave today, tomorrow or a week from now. ... Read More